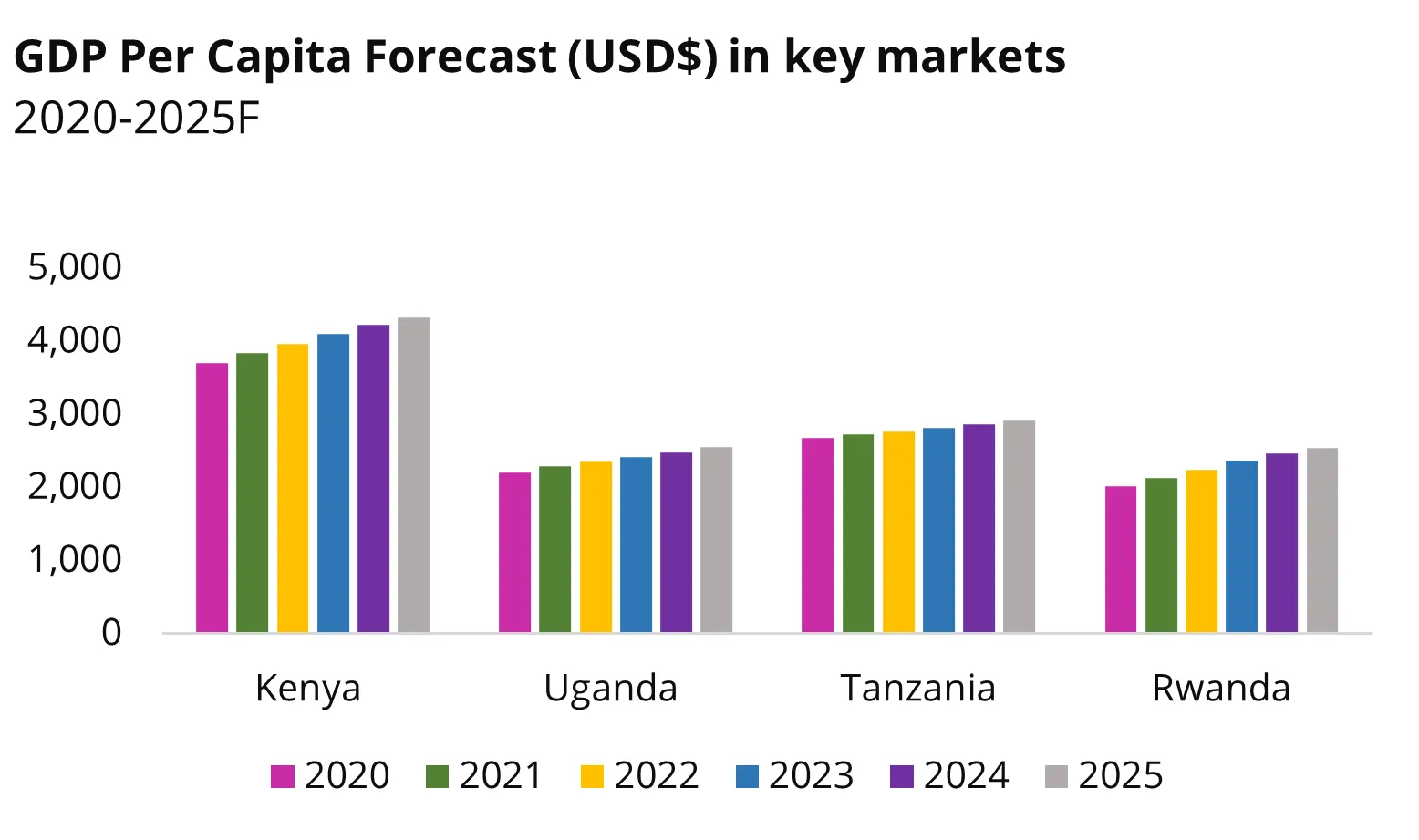

EG Capital is investing in four countries in the East African region: Kenya, Uganda, Rwanda and Tanzania with a further remit in Zambia when the opportunities arise. Our selected markets represent some of the world’s fastest growing economies where population growth, rising incomes and urban demographic shifts are driving sustained consumer-driven economic expansion. This accompanied with significant increases in literacy, access to electricity and high penetration and uptake of digital technology is expected to drive productivity growth across a number of different sectors. With relatively diversified economies and an existing competitive foundation to build more sophisticated industries and value-chains, these countries in the Target Region are also projected to outpace the growth of their more commodity-dependent neighbours and compatriots across the rest of the continent.

According to the African Development Bank, East Africa has maintained the highest growth rates across the continent for the last 5 years (since 2017) and is forecasted to maintain this position for the next five years (until 2027), even considering recent economic challenges created with the COVID-19 pandemic.[1] The World Bank Group has also retained Kenya’s growth projection at 5.5 per cent for 2022 in its latest country economic update [2] against economic shocks (including the impact of the Russia-Ukraine war). The multi-lateral lender has also retained its outlook for 2023 and 2024 at 5 per cent and 5.3 per cent, respectively, the same rate as in June 2022. World Bank expects growth to be anchored on improved private consumption and gains on fiscal consolidation even as shocks, including drought, rising inflation and tighter global financing conditions.

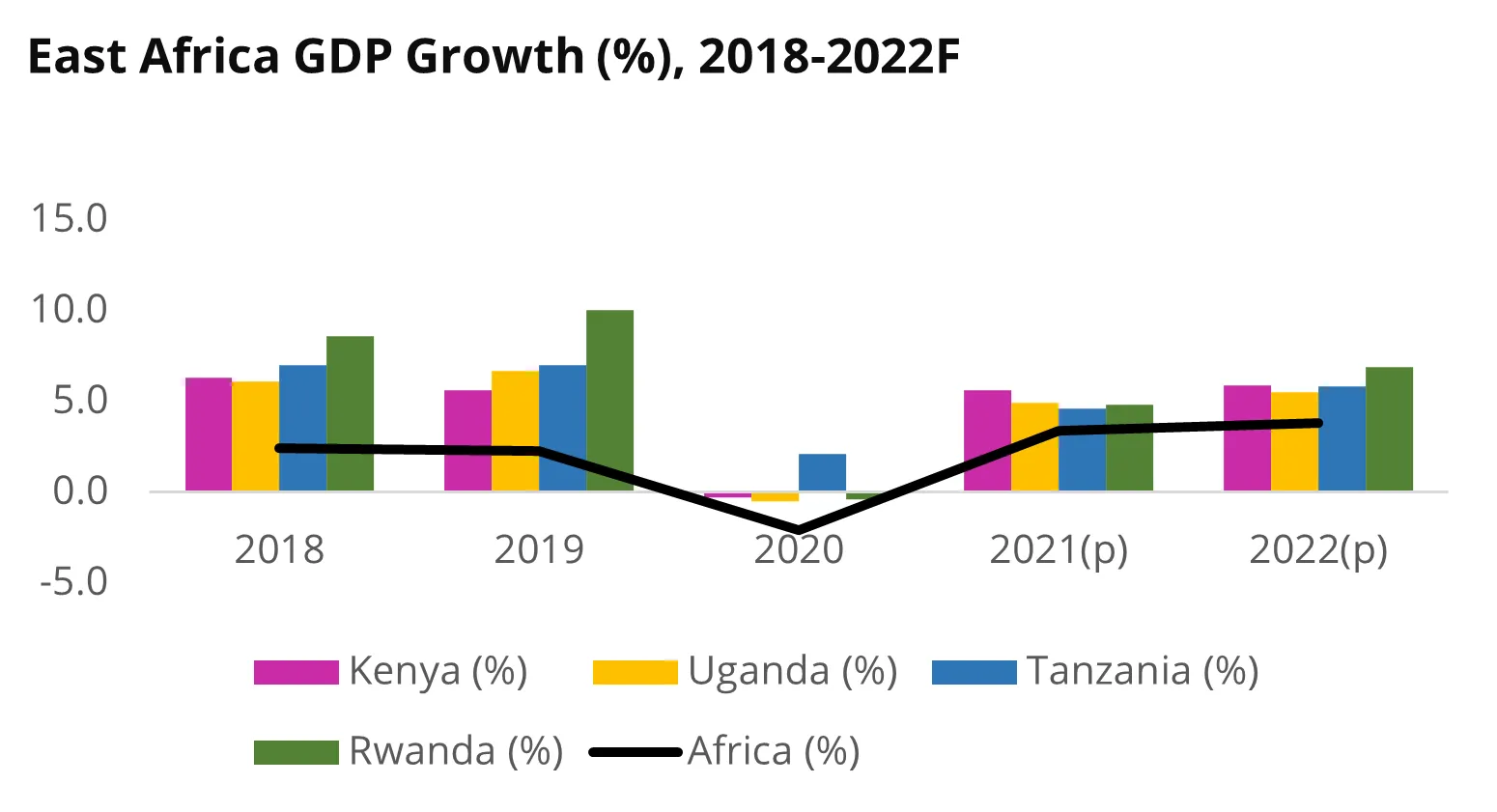

Despite being faced with similar challenges revolving around limited physical movement, low confidence and constrained liquidity that has induced a sharp contraction in overall demand and disrupted supply chains, East Africa’s economies proved to be more resilient than their continental and global peers in the face of the Covid-19 pandemic.

The resilience was driven by their low commodity dependence, large informal sector activity coupled with an entrepreneurial culture, and relatively stronger penetration of digital technologies within more diversified economic sectors that allowed business activity and transactions to continue despite safety restrictions. These traits have signalled to a strong rebound for growth in the years post-pandemic and beyond with many market experts projecting growth in excess of 5% for all the economies of East Africa over the medium term. [3]

Many experts project that growth in this region will continue to accelerate steadily in the long-term, as demonstrated below:

Medium-sized businesses play a pivotal role in these emerging economies, contributing up to 60 per cent of total employment and 40 per cent of GDP, but have traditionally limited access to financing. [4]

We therefore seek to capitalise on this enhanced demand for capital, alongside the competitive growth profile of the region, to not only generate strong financial returns and improve the enabling environment for health, nutrition and education delivery, but also to create quality local employment opportunities.

EG Capital will achieve this by working alongside our Portfolio Businesses, supporting them to better serve the growing low and middle-income consumer segment, build expansion strategies, grow team capacity and scale their businesses regionally. The team will work to harness and multiply the intangible assets of investee companies.

EG Capital actively screens for businesses with a track record of creating inclusive employment opportunities and of serving customers in rural areas, and regionally diversified.

The World Bank Group has retained Kenya’s growth projection at 5.5 per cent for 2022 in its latest country economic update [5] against economic shocks. The multi-lateral lender has also retained its outlook for 2023 and 2024 at 5 per cent and 5.3 per cent, respectively, the same rate as in June 2022. World Bank expects growth to be anchored on improved private consumption and gains on fiscal consolidation even as shocks, including drought, rising inflation and tighter global financing conditions.

Global leaders and delegates at the COP27 conference earlier in November 2022 have been warned of the addiction and dependence on fossil fuel. There is broad consensus that the emission of gases produced by fossil fuels must be dramatically cut by 2030 to keep the global temperature rising to 1.5 degrees and to avoid the most damaging effects of climate change. Russia’s invasion of Ukraine has also disrupted the markets and geopolitics of energy. In Kenya, this has also manifested itself as an increase in fuel prices leading to inflation hence a higher cost of living.

A section of Kenyans has had to make do with loans to purchase food as the cost of living soars significantly, driven primarily by high food prices. According to a survey by the World Bank [6], 12 per cent of households in Kenya have resorted to taking out loans to purchase food in the face of food price shocks whilst 34 per cent of households have meanwhile reported making purchases on credit in the face of shocks.

The rapid response survey by the World Bank, which is now in its eighth edition, first captured coping strategies and food security during the COVID-19 pandemic but has since been expanded to capture inflationary pressures and climate shocks. Food inflation peaked at 15.8 per cent in October 2022 as inflation set a new high of 9.6 per cent in the month before easing slightly to 9.5 per cent in November 2022.

Inflation is projected to ease back to the government target range of 2.5 to 7.5 per cent at 7.3 per cent at the close of the year and later fall to 5.5 per cent in 2024. The fiscal deficit is meanwhile estimated at 6.2 per cent of GDP, with debt as a percentage of GDP at 67.3 per cent, while the current account deficit (CAD) is seen at 6 per cent of GDP in 2022.

View our Modern Slavery Act Statement.

Read our GDPR Privacy and Cookies Policy

SFDR statement since March 2021.

Issued by EG Capital GP in Mauritius, regulated by the Financial Service Commission. The information displayed on this website is for eligible counterparties and professional clients only and is not for retail clients. The services described may not be available to you, or suitable for you. Nothing in this document constitutes investment advice nor does it represent any offer to provide services to buy or sell securities of any kind. Investments in the portfolios managed by EG Capital may fall as well as rise and investors may not be able to recover their invested capital.

Copyright © EG Capital 2024. All rights reserved.