The education sector across the world was one of the hardest hit by the COVID-19 pandemic. Government enforced lockdown measures forced schools to shut-down and millions had to drastically changed the process of teaching and learning. Students had to get used to distance learning via digital platforms due to social distancing.

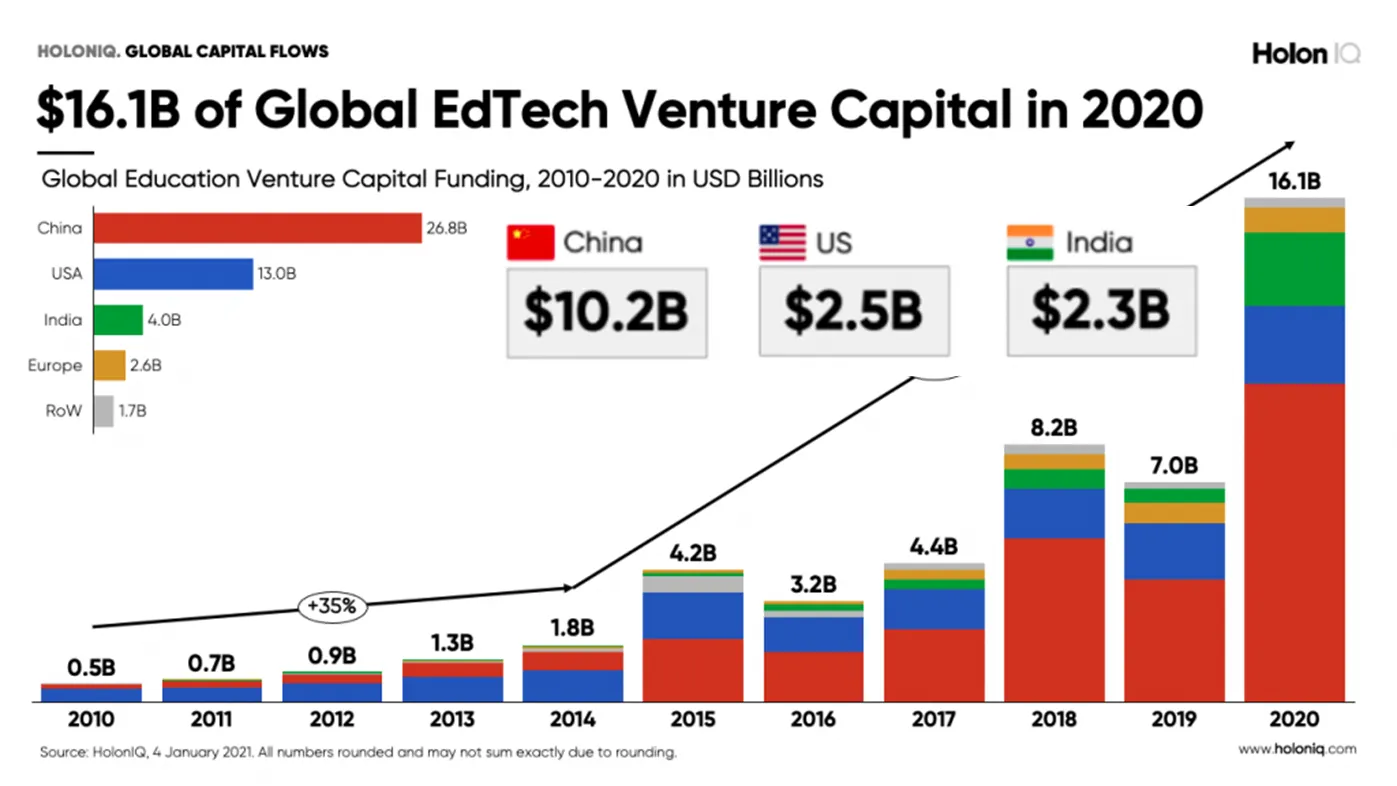

COVID-19 brought about pandemic-forced distance/remote learning and with it a surge in demand for online and technology-based learning, teaching and education tools, as such 2020 became a ground-breaking year for the education technology sector. U.S. education technology start-ups alone raised over $2.2 billion in venture and private equity capital across 130 deals in the pandemic years. That was nearly a 30 percent increase from the $1.7 billion invested in 2019, which was spread across 105 deals [1]. Across the world, over $16 billion of capital was deployed to the EdTech sector primarily as venture funding and Asia as a continent now makes up nearly 80% of all global VC dollars invested.

The absence of Africa within this trend, however, was a stark reminder of the inequalities in technological advancement and access. EdTech in Africa today is a small fraction of the Global market having attracted only $20M in venture capital between 2019–2021 to-date.

In 2020, most countries in Sub-Saharan Africa had Government mandated school shutdowns and thousands of students had to shift to online and distance learning. However, challenges around access to base infrastructure (electricity and internet) and hardware (mobile devices) have been cited as the key hindrance to the transformative impact of EdTech [2].

Access to base infrastructure and hardware that would allow students and teachers the ability to leverage education technological developments are seemingly not up to the level or standard to induce a growth in EdTech as witnessed in other countries. So where do countries like Kenya stand?

Widespread access to affordable energy sources is the fundamental precursor to the adoption of digital technologies and indeed is seen as a significant proxy for economic development through the improved productivity that comes with access to electricity. Kenya has made significant progress in providing access to electricity to its population and the number currently stands at 75% - this is the highest in East Africa. By 2030, over 90% of the population is expected to have access to electricity [3].

Putting this into the context of education, Kenya currently has around 7.5 million households connected to power and has also made significant progress in connecting schools to the national grid. Following the introduction of the Government’s digital learning plan [4], the Rural Electrification Agency has connected close to 98% of primary schools and above 75% of secondary schools to electricity [5].

According to the Digital 2021: Kenya report, about 40% of the population or 21.75 million people are internet users in Kenya (about half of which are active social media users) [6]. This growth in internet access has been primarily driven by the influx of affordable smart phones, the number of mobile connections between January 2020 and January 2021 grew by 11% or 5.9 million more connections. This number significantly drove the number of internet and social media users with the latter growing by about 25% or 2.2 million additional users. Kenya currently has the highest internet penetration in Africa [7] and is ranked 3rd on the continent behind Egypt and Nigeria in terms of the absolute number of internet users [8].

In terms of cost, Kenya ranks 7th in Africa as the cheapest internet data charges falling behind Tanzania and Rwanda in Eat Africa who rank 4th and 5th in Africa respectively. The cost is also reflected in the high purchasing rates of data bundles which take up about 4% of average income [9].

Of the internet users in Kenya, 96% access the internet via a mobile device and while about 60% of internet users own some kind of laptop or desktop computer, the web traffic access by laptops and desktops has been on the decline with only 24% of web access in Kenya being recorded as coming from a laptop or desktop and only 1.1% of it coming from tablets.

This is in stark comparison to the 74% of web traffic coming from mobile phones [10]. Internet users in Kenya using mobile phones further registered a total of 290 million app downloads in 2020 and spent $60 million on mobile apps in the same year.

Despite significant strides in access to base infrastructure and hardware, it is clear that the majority of Kenyans use the internet through their mobile phones primarily to access social media pages and assist in their commercial activities or general work. As described earlier, more than 96% of Kenyans access the internet through a mobile device and from the list of top ten app downloads, the top 3 were social media apps and from the top ten app spending, only one was in education (Udemy, the EdTech open online course provider) [11].

It is clear that the adoption of education technology is not simply just a function of access to base infrastructure and hardware, Kenya has made very significant progress in its path to digitalization, but the use of the internet and mobile devices is currently focused on entertainment, communication and commerce. This may speak to a more traditional outlook towards education as being primarily a physical process and one that requires in person teaching and learning.

EdTech will be a complementary development that will support the access, affordability and quality of education across all its forms. Therefore, the immediate opportunities that exist within the EdTech space are championed by those companies developing and offering a blended approach to education delivery that uses both traditional, in-class delivery and leverages this to develop and roll-out proprietary technological applications, learning aids and other tools for both internal and external use. This blended approach offers a unique opportunity for immediately commercially viable projects, leveraging on high demand for physical education delivery aforementioned as well as an early entry into a technology market that will inevitably become larger and larger as the infrastructure is developed over the next ten years.

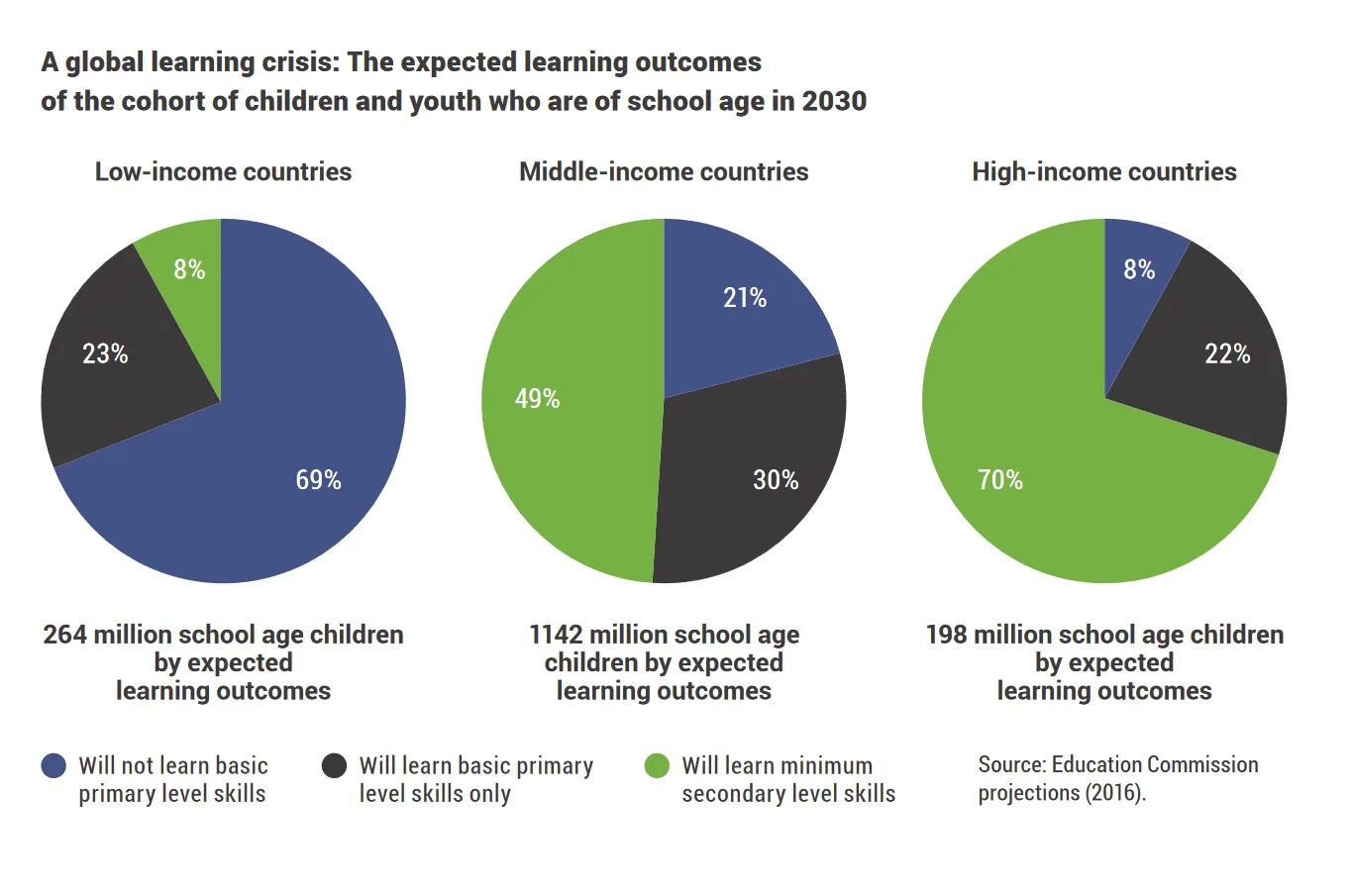

The UN Commission on Financing of Global Education (Sacks, 2016) [12] has projected that if trends continue, by 2030 just four out of 10 children of school age (approximately 1.4 billion children) in low and middle income countries will be on track to gain basic secondary-level skills, which means that there remains considerable work to be done in order to achieve the Sustainable Development Goals for education.

Despite the progress made in developing countries over the last decade, 67 million children worldwide, of whom approximately 53 per cent. are girls, do not have access to basic education.

UNICEF [13] identifies the following issues as constituting significant barriers to education in developing countries:

For girls, children from minority ethnic groups, children with disabilities, and children living in conflict areas, the barriers are even greater. As barriers to education are broad and vary greatly by locality/region, EG Capital will take a cross-sector approach looking at investable projects in health, nutrition, and education infrastructure that affect children's access to quality education.

The Manager will look for companies developing high quality affordable products and services locally where communities will lead the process of removing barriers to education themselves.

Finally, the education sector seems largely under-invested relative to other sectors. A survey by JP Morgan (2015) [15] shows that 58 per cent of the capital allocated to impact investing (AUM US$60 billion) flows towards housing, agriculture, energy and micro-finance, compared with only two per cent invested in education. Yet, the education sector is, perhaps undeniably, one of the most strategic sectors for these economies. The lack of capital investment in the education sector bodes lasting consequences in terms of security, stability, community well- being, livelihoods and opportunities for emerging and developed market economies alike.

The Manager has also conducted its own proprietary analysis to highlight countries with a significant gap where educational attainment continues to lag behind despite strong economic growth. In countries where approximately less than 20 per cent of children enrol in secondary education, it is difficult to imagine how improved livelihoods, well-being and social progress can be sustained over time without educated citizens. Yet, in the Manager's opinion, there is an opportunity, given underlying demographics and economic resources, to bring millions out of poverty by investing in Education. Indeed, an educated workforce is essential for stimulating sustainable economic growth and reducing poverty [16].

The East Africa Community is a 146 million people market experiencing strong economic growth, yet secondary education enrolment rates of around 20 per cent for Uganda, Tanzania, and Rwanda are too low by far. Kenya seems to 'excel' in the region, yet secondary education enrolment rates are still below approximately 33 per cent [17]. Despite reliance on grants and donations, EG Capital believes the Target Region meets most of the pre-conditions required for successful investment in education thanks to its improved infrastructure, road, transport networks, advances in mobile payment and technology.

The Education Commission proposes that getting all children in some form of education will require total spending on education to rise steadily from US$1.2 trillion per year today to US$3 trillion by 2030 (in constant prices) [18]. With governments budgets squeezed due to rising population and an increased demand for education, EG Capital believes that there is a large role for private investment to help shape education across Sub-Saharan Africa [19].

View our Modern Slavery Act Statement.

Read our GDPR Privacy and Cookies Policy

SFDR statement since March 2021.

Issued by EG Capital GP in Mauritius, regulated by the Financial Service Commission. The information displayed on this website is for eligible counterparties and professional clients only and is not for retail clients. The services described may not be available to you, or suitable for you. Nothing in this document constitutes investment advice nor does it represent any offer to provide services to buy or sell securities of any kind. Investments in the portfolios managed by EG Capital may fall as well as rise and investors may not be able to recover their invested capital.

Copyright © EG Capital 2024. All rights reserved.